Table of Contents

Don White

A year ago, I wrote an article about Richardson Electronics (NASDAQ:RELL) titled Richardson Electronics Is Cutting Edge, Profitable, And Growing Yet Trades Below Book. At that time, I categorized it as a turnaround play. A stock that had performed poorly for years and been left for dead by investors, despite strong recent evidence of a turnaround. The stock was trading at $8.00 and I placed a one year price target of $14.00. It is now one year later and the stock has risen to $15.79.

If you are a value investor, it’s still a value. It’s trading at a run rate PE ratio of about 10 despite increasing growth. But RELL is now also in the early stage of full throttle growth. It has at least four major new product lines just coming to market or in beta testing in secular growth industries. Three already have large orders. All are potentially large markets that are less cyclical than most. In fact, three of them are EVs, wind power, and lab grown diamonds.

I believe the opportunity today is as great as a year ago despite the doubling of the stock. This is due to the transition to a growth company. The stock trades at a forward PE ratio of about 10. The market has recognized the turnaround but not the growth story.

Background

Richardson is an electrical components manufacturer and distributor based in La Fox, Illinois. It designs or manufactures over half its products and serves as a distributor for the rest. The distributor business is value added so it gets better margins than most distributors. They often help their customers with engineering or other custom services. The customer base is diversified with its largest customer at about 10% of revenues. It’s also very diversified by the industries of its customers.

The company was founded in 1947 by the current CEO Ed Richardson’s father. Mr. Richardson has been with the company about 60 years and is now 80. His mother worked there until she was 95 and he does not plan to retire. Mr. Richardson owns 15.2% of the common stock and 98.2% of the Class B common stock. That gives him control with 62.5% of the voting rights. He plans a book shortly about the company history called Never Give Up.

Financial Results

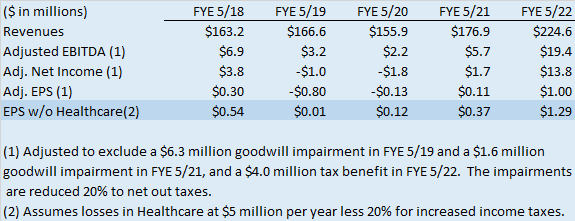

Financial results over the last five fiscal years are shown below.

Richardson forms 10-K

As shown above, the company was operating close to breakeven with declining sales in the three years ended May 2020. The worst year was YE 5/20 when revenues fell 6%. Sales began to pick up in FYE 5/21 and accelerated, growing by 27% in FYE 5/22.

The company has been losing at least $5 million per year with its CT tube aftermarket business started from scratch about seven years ago. This level of loss goes back many years. That business has been very slow to develop but is starting to get traction. In the shaded line in the chart above, those losses are added back to show how profitable the rest of the business is. It shows the company earned $1.29 last fiscal year if adjusting out the healthcare segment losses.

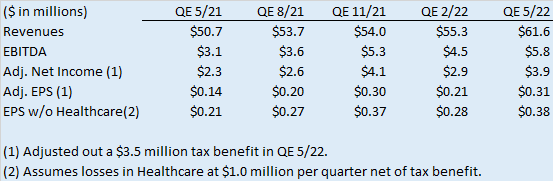

The chart below further breaks down the jump in revenues and earnings by quarter.

Richardson forms 10-Q and 8-K

Earnings leverage is shown as a 21% YoY revenue increase in QE 5/22 led to an 81% earnings increase, net of healthcare.

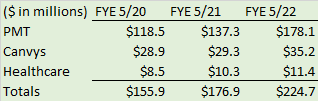

The chart below breaks out revenues by segment.

Richardson forms 10-K

PMT is Power and Microwave Technologies. The company describes this segment as including products for power, RF and microwave applications for customers in 5G, alternative energy, aviation, broadcast, communications, industrial, marine, medical, military, scientific and semiconductor markets. All of the high potential growth new product lines discussed later in this article are in this segment. The company plans to break out these new product lines into a new segment called Green Energy Solutions starting next quarter so investors can watch the growth.

Canvys manufactures touch screens primarily for large medical equipment. It includes protective panels, custom enclosures, all-in-one computers, specialized cabinet finishes and application specific software packages and certification services.

Healthcare includes diagnostic imaging replacement parts for CT and MRI systems, replacement CT and MRI tubes, CT service training, MRI coils, cold heads and RF amplifiers, hydrogen thyratrons, klystrons, magnetrons, flat panel detector upgrades, and pre-owned CT systems. The big initiative here is replacement CT tubes.

Going Forward

The backlog increased to $206.2 million in the fourth quarter (QE 5/22) versus $175.6 million at the end of the third quarter and $110.0 million at the end of the fourth quarter of last fiscal year. The backlog increases are primarily before any impact from their new product lines

In an online interview on August 30, 2022, CEO Richardson projected 15-20% revenue growth going forward for at least the next four years. He previously guided for a 10% revenue increase guidance for Fiscal 2023, when the QE 5/22 results were reported. He also guided that the quarter just ended was a record quarter for sales.

Growth Catalysts

This is a company with numerous catalysts to significant revenue and earnings growth. It has four major new product lines just getting going. Richardson operates in many high growth, trendy segments such as EV, 5G, alternate energy, healthcare equipment, hydrogen production and semiconductors. Richardson expects to carve out a Green Energy Solutions segment in its SEC filings starting next quarter to show the growth in sales in this area. This will include the first four detailed below.

1. Wind turbine ultracapacitors– The company has a major rapid growth new product with its ultracapacitors known as the ULTRA3000. This product is used to power the adjustment of the pitch on wind turbines. It replaces batteries previously used for that purpose. It can last 10-15 years versus about 2 for the batteries it is replacing and less impacted by weather. Each wind turbine takes 18 ultracapacitors costing about $10,000 combined. The company has already shipped a $10 million order for 1,000 GE wind turbines in 2022. There are 30,000 GE turbines in the U.S. It is also in talks with Siemens (OTCPK:SIEGY) and Vestas (OTCPK:VWDRY), both of which are both about twice the size of GE in the U.S. A total TAM just in the U.S for existing wind turbines is at least $1.0 billion. That excludes foreign turbines, new turbines and replacements. Shipping and revenues started in the first quarter of calendar 2022.

rell.com (Richardson)

2. Cell Tower ultracapacitors – Richardson has a similar ultracapacitor that can also replace the backup batteries in cell towers. Their unit costs about $500 each and there are about 300,000 cell towers in the U.S. for a total TAM of $150 million. That is just U.S. and excludes cel tower growth. These ultracapacitors are in beta testing with T-Mobile (TMUS), AT&T (T) and Verizon (VZ). T-Mobile is furthest along. Revenues are expected in the first half of 2023.

3. Lab grown diamonds equipment components – Another hot new product is a magnetron used to develop lab grown diamonds. It is a component of a larger piece of equipment. This is also a high growth industry and they cannot keep up with demand. The company already has orders for 5,000 units at about $3,000 each. These are already being shipped. The company is also developing a generator for a similar piece of equipment that can be sold for $10,000-$100,000 each. These can potentially also be used to convert methane gas to hydrogen and materials used to make vinyl.

4. Locomotive battery units – Management believes this may be the largest new market of all. Richardson received a $18 million contract in May for batteries from Progress Rail. Progress is a locomotive manufacturer and a subsidiary of Caterpillar. Each locomotive takes 162 battery modules for a total of $1 million per locomotive. Caterpillar is in the process of initiating electric train manufacturing in Indiana, much closer to Richardson’s Illinois factory than it’scurrent operation in Brazil. Richardson assembles the modules using ultracapacitors and lithium iron phosphate batteries purchased from a manufacturer in South Korea and adds fire protection.

5. Semiconductor wafer fab products – These are RF matches manufactured primarily for Lam Research (LRCX), one of the largest fab equipment manufacturers, and also other majors such as Applied Materials (AMAT). This has been a high growth market though cyclical. This was a big driver of revenue growth last fiscal year. The recently passed Chips and Science Act provides roughly $55 billion in grants and loan guarantees to increase US semiconductor production. This should stimulate demand though it may take a few years to get going. In the meantime, the semiconductor industry is showing signs of slowing. Richardson has a large and growing backlog (currently $39 million) here so is insulated from any immediate slowdown.

6. CT replacement tubes – This is not a new product line. They have been developing it for over 7 years. The company currently has replacement tubes on the market for Toshiba CT Scanners and will go to market with CT Tubes for Siemens shortly. Since Siemens makes 10 times the CT machines as Toshiba, they expect to get traction with significant shipments starting in 2023. As mentioned earlier, losses in the CT replacement tube business are $5 million annually. If they can get traction that loss will go away and become a profit center and another main leg of revenue growth. If the Siemens tubes don’t gain traction by 2024, I expect them to shut this business down and save $5 million a year.

More Catalysts and Strengths

7. Supply chain and labor – Like many other manufacturers and distributors, Richardson is impacted by logistics and supply chain issues. The company is also growing its workforce and currently has 38 jobs open for a 450 person staff. That is also holding them back. This indicates they will have more revenues as supply chain and labor availability issues fade. A recession will actually benefit them in that way.

8. Balance sheet – Richardson sold a large operation in 2011 for $238 million in cash. That strengthened the balance sheet. As of May 28, 2022, Richardson had a tangible net worth of $134 million, $40.5 million of cash and investments and no interest bearing debt. Richardson’s strong balance sheet allows mergers and stock buybacks if they choose to do so. They are currently paying a dividend yielding 1.5%.

9. Earnings leverage – Since the large business segment sale in 2011, Richardson lost money or had slim profits until 2021. This was due in part to an unwillingness to cut capacity in line with lower revenues. Now that revenues are rising, it has more than enough capacity to absorb it without adding much fixed costs. This means that a high percentage of any increased revenues drop straight to the bottom line. The last two fiscal years have shown this effect particularly well.

10. ESG – Richardson is rapidly becoming an ESG company with its ultracapacitors and other new products used in wind turbines and other renewable energy. Other environmentally friendly new products include magnetrons for lab grown diamonds and batteries for electric trains. This should start to attract ESG investors. Richardson is creating a new segment called Green Energy Solutions so investors can see and track growth in this area. Not mentioned as a catalyst above is Richardson is now exploring using ultracapacitors for solar power.

11. Less cyclical – Most of their newer growth areas are secular and should continue to grow right through a potential recession. These include wind turbines ultracapacitors, cel tower ultracapacitors, locomotive batteries, 5G products and lab grown diamonds. About 10% of sales are to semiconductor equipment manufacturers which has been cyclical.

Concerns

With any stock, there are concerns.

The CEO, Edward Richardson has a controlling interest in the stock. That is a two-edged sword. On the one hand, the CEO cannot be fired for doing a poor job. The years of weak results would have cost many other CEOs their job by now. Specifically, the seven-year pursuit of the CT tube business with its high losses does not indicate a good allocation of resources. On the other hand, the CEO is all in and thinks long term. His interests are aligned with the shareholders. His compensation is normal for a company this size. He has taken a long-term approach and was willing to take short-term losses in the newer healthcare segment, in order to grow the company. He is also avoiding financial engineering with cash on hand and using it instead to fund growth.

About 10% of sales are currently to a semiconductor equipment manufacturer. Stock prices in the semiconductor industry have fallen considerably lately due to signs of a slowdown. This should actually be a strength in a few years with the Chips and Science Act passed. Also, Richardson has a big backlog in this area right now, so if sales slow it won’t happen for a while.

Richardson had a long history of losses or low profits until two years ago.

Like most manufacturers, Richardson is impacted by supply chain shortage and logistics issues. This should be a tailwind as these issues fade.

Valuation

To determine a valuation, I first determined a current run rate for Richardson’s earnings. Then it was compared to other electronic component manufacturers with under $2.5 billion in revenues. These are a diverse group but mostly focus on supplying manufacturers with electronic parts. There are no direct competitors to Richardson as there are no other publicly traded primarily tube companies and no one who overlaps a large portion of their product offerings.

Richardson earned $0.31 in its most recent quarter when adjusting out a tax benefit. That number increases to $0.38 when factoring out discretionary losses in the healthcare segment. Annualized that’s about $1.50 EPS. This number appears usable based on the prior several quarters earnings and their growth rate.

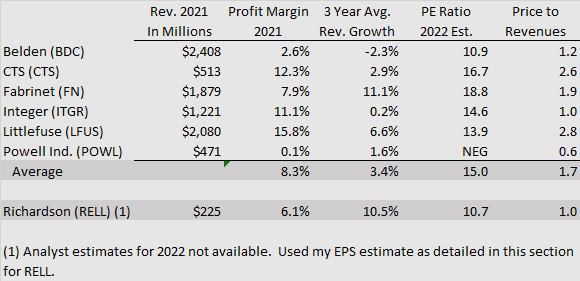

Comparable companies are summarized below.

Yahoo Finance, Value Line & Forms 10-K

Richardson is smaller than its competitors but growing faster than all but Fabrinet (FN). This has been a slow growth industry. It also has a better balance sheet than all but Fabrinet. Fabrinet and Littlefuse (LFUS) are the best in this industry based on growth and profit margin. Powell (POWL) is currently unprofitable and is shown only as a floor. Richardson compares well to Fabrinet and Littlefuse, especially if you add back the losses in the healthcare segment to their profit margin. They need to be discounted for smaller size and being closely held. However, they have a greater growth potential at this point than both due to smaller size and the wave of new products in secular growth industries.

Based on the comparables, I believe Richardson should trade at a PE ratio of 18. Applied to my EPS run rate of $1.50 that is a price of $27.00. This PE ratio is just slightly above the S&P average of about 16 right now. Richardson, being a growth company, has better growth prospects than the market. They are currently growing revenues by double digits and earnings even faster due to excess capacity. I believe a price to book of 1.8 is also appropriate. It is slightly below the peer if Powell is excluded. That indicates a stock price of $29.35. Combining the two, I reach of one year price target of $28.00.

Takeaway

The market is not yet recognizing Richardson Electronics for the growth company it has become. I recommend a long position in the stock. The price target is 77% above the current stock price of $15.79. This target assumes a recession, as most of their growth products are in secular growth markets unlikely to decline in a recession.