The online video gaming sector is a $195.6 billion dollar business with a predicted CAGR of 14% by way of 2030 – and through the previous economic downturn, back again in 2008, it ongoing to see strong profits progress.

Online games have a amount of characteristics that add to their success in down-bound markets. To begin with, clients will carry on to invest in gaming solutions, and once procured, video games can continue on entertaining over an extended period of time of time. Several gaming firms also supply cost-free-to-enjoy online games, on line or for down load, that operate as loss-leaders, and the gaming firms can even now profit from in-sport purchases and compensated on the net ads.

The upshot of it all is that the gaming sector could provide buyers a seem defensive place in a recessionary environment. We can follow that logic, using a cue from Southeast Asia’s biggest bank, Singapore’s DBS, which has been tagging the large gaming shares as Buys, with upside probable on the order of 20% or far better. DBS is not alone in its upbeat assessment in accordance to the TipRanks databases, the two are rated as Strong Buys by the analyst consensus, too. Right here are the particulars, together with commentary from DBS.

Electronic Arts, Inc. (EA)

We’ll start out with Electronic Arts, a $34 billion large of the gaming sector. The enterprise, based mostly in Silicon Valley, offers a solid portfolio of video games, which include these titles as Jedi Survivor, FIFA 23, Madden 23, and Medal of Honor Above and Beyond. Digital Arts added benefits from possessing copyrights on a lot of common sport franchises, and from its rewarding agreements with qualified sports leagues.

All through 2022, EA shares slipped, like considerably of the tech sector, but by only 7%, that means EA outperformed the NASDAQ index by a aspect of 5. This relative outperformance came as EA also showed year-in excess of-year gains on a number of key metrics. In the most modern economical release, for Q2 of fiscal year 2023 (the quarter ending on September 30), EA showed a major line profits of $1.9 billion, up 5% from the $1.8 billion claimed in fiscal 2Q22. This earnings was supported by usually potent business, like internet bookings for the trailing 12 months of $7.38 billion, a full that was up 4% y/y.

At the bottom line, EA’s internet money came in at $299 million, in comparison to $294 million in the prior-calendar year quarter, with EPS becoming documented at $1.07 for a 5% y/y gain.

Covering this stock for DBS, analyst Tsz Wang Tam sees the company in a good place to carry on developing, even as video match desire slows write-up-COVID, with a particular benefit coming from the sports activity franchises. He writes, “The pandemic has accelerated the adoption of digital games, live products and services, and new platforms. Digital Arts (EA)’s games and products and solutions empower the company to catch the growing desire in many nations around the world and locations, primary to above-peer ordinary EBITDA growth of 26%…. EA has a large sporting activities franchise and 300+ special licenses to publish football simulation video games. EA’s biggest recreation FIFA has dominated the sporting activities game sector. Aside from, EA has a strong pipeline with athletics video games scheduled for release, which will push development over the coming years.”

Pursuing from this stance, Tam provides the stock a Get rating, with a $165 price tag goal to counsel a a person-12 months upside likely of 32%.

The Powerful Buy consensus rating on EA is based on 10 latest Wall Road analyst critiques, with an 8 to 2 breakdown favoring Invest in over Hold. The recent trading cost is $125.01, and the normal selling price focus on of $149.60 implies a 20% upside for the coming yr. (See Electronic Arts’ inventory forecast at TipRanks.)

Activision Blizzard (ATVI)

Following up is an previous name in the gaming small business, Activision Blizzard. This is one of the world’s premier gaming providers, with a $60 billion market cap, and below the Activision name it dates back again to the earliest times of dwelling laptop video gaming – some of Activision’s initial titles were unveiled for cartridge-loaded sport consoles in the early ‘80s. Today, Activision Blizzard is the owner of this kind of key on the internet game titles as World of Warcraft, Connect with of Obligation, and Candy Crush. The enterprise operates by esports, client solutions, and media divisions.

The greatest information about the past calendar year for Activision Blizzard was the announcement, in January of 2022, that tech large Microsoft was concentrating on the gaming company for acquisition, with Microsoft proposing a $68.7 billion all-income transaction. In the most latest update, on December 8, Activision Blizzard’s CEO introduced that the Federal Trade Fee was submitting fit to block the merger. Both businesses are tough the regulatory authority’s action.

Even immediately after information of the regulatory challenge to the proposed merger, ATVI shares remain solid. The stock acquired 14% in 2022, and in the past documented quarter, 3Q22, the firm conquer anticipations on both profits and earnings. Though the prime and base lines the two fell calendar year-over-year, the $1.78 billion in earnings was 4.7% above the forecast, and the 55-cent GAAP EPS did even superior, beating expectations by 31%.

Checking in once again with Tsz Wang Tam, for the DBS perspective, we come across that the analyst has outlined a solidly bullish situation on Activision Blizzard shares, stating of the company’s potential customers, “Activision Blizzard is nicely positioned to capitalize on its recreation homes by using reside services offerings, which make it possible for gamers to obtain and make investments in new articles and boost engagement. Currently, stay services (or in-match invest in) earnings tends to make up 38% of whole profits, generally contributed by Sweet Crush. The continual concentrate on in-match content and stay provider progress will generate larger income with a bigger margin…. We expect mobile online games to become a significant income growth motor in the coming a long time, driven by the robust cell recreation pipeline and expanding addressable audiences.”

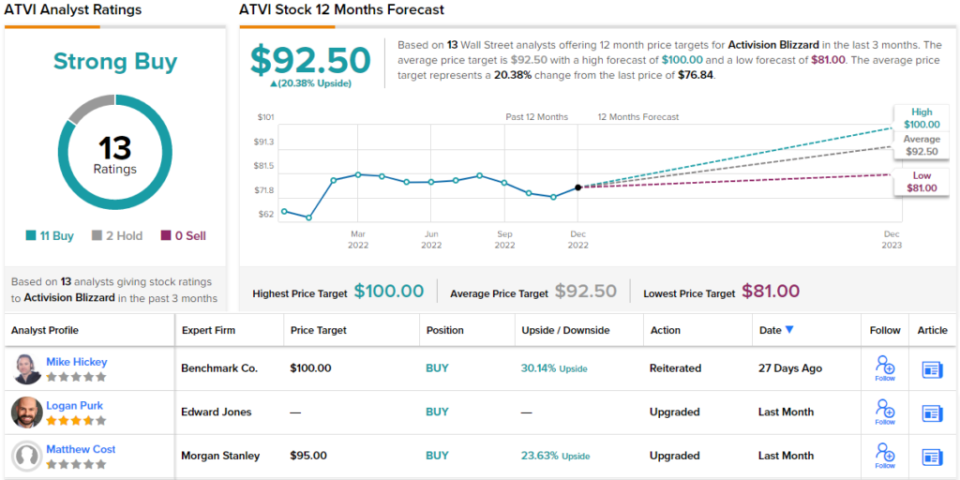

These comments occur with a Purchase score, and Tam’s $92 cost target implies a 12-month upside possible for the inventory of 20%.

Activision Blizzard finds guidance for its Sturdy Obtain consensus score from 13 modern analyst opinions, like 11 to Invest in and just 2 to Keep. The common cost goal of $92.50 is just about the exact as Tam’s goal. (See Activision Blizzard’s stock forecast at TipRanks.)

To come across good concepts for shares buying and selling at interesting valuations, pay a visit to TipRanks’ Very best Stocks to Get, a freshly introduced device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this report are solely these of the highlighted analysts. The articles is meant to be utilised for informational applications only. It is quite important to do your own evaluation just before making any expense.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25006793/IMG_3844.jpeg)